Meeting regulatory requirements and unlocking the last mile to enhance client and advisory relationships. We understand the challenges facing the banking and advisory environment, with the product due diligence (PDD) requirements and regulatory scrutiny that has intensified over the past few years, making the digitization of this crucial process in the product supply chain a must-have.

For the firm to compete and meet increasing interest and demands from family offices, ultra-high and high net-worth individuals in Sustainable and ESG related investments, it is a requirement for banks and advisories to screen and exclude assets that misalign with the families or the investors' value system. By Integrating the Bespoke Gatekeeper Workbench between fund houses and the bank or the advisory, you are giving RM an extra mile to integrate the customer experiences with the advisory process, helping the firm differentiate.

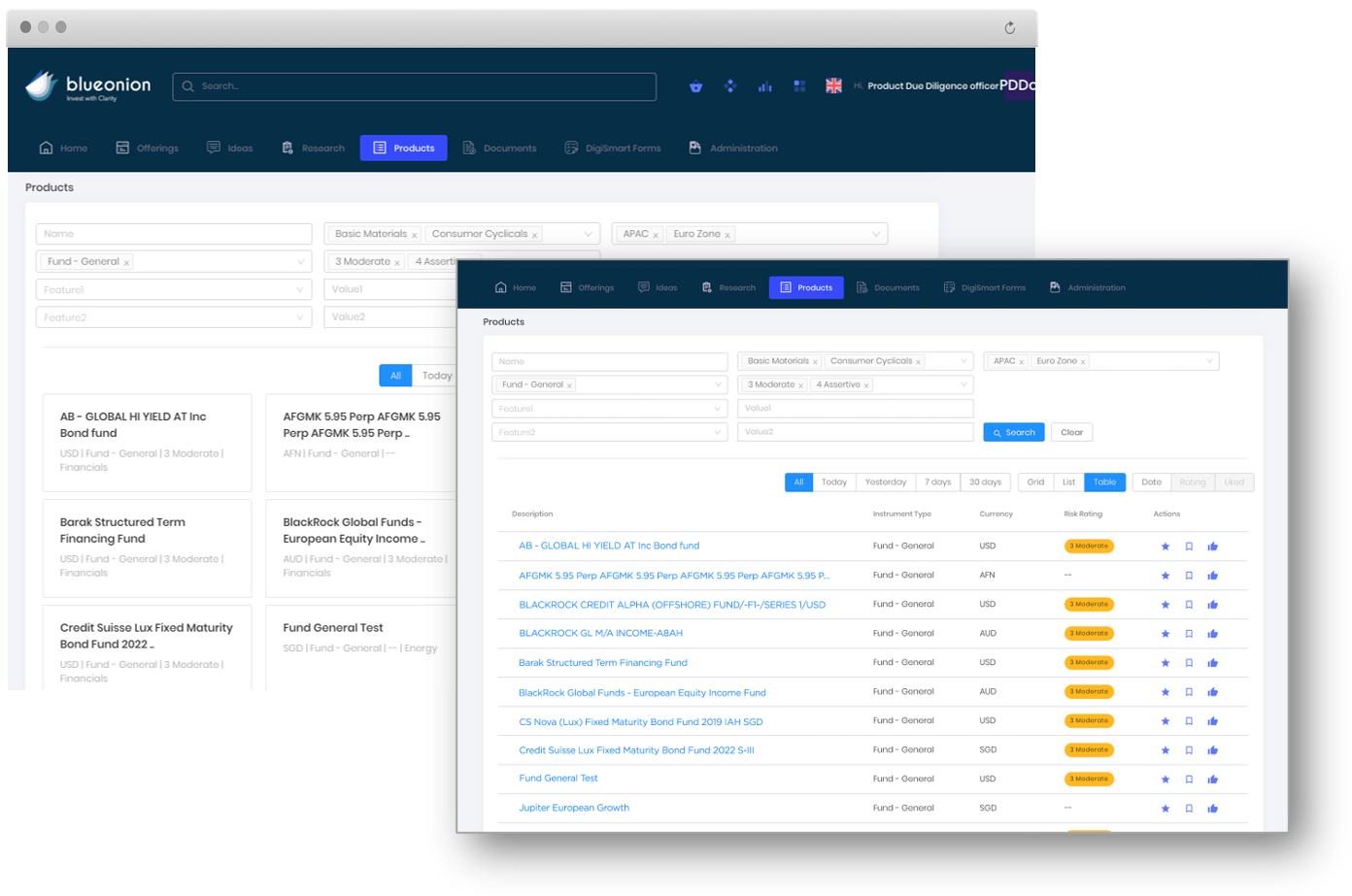

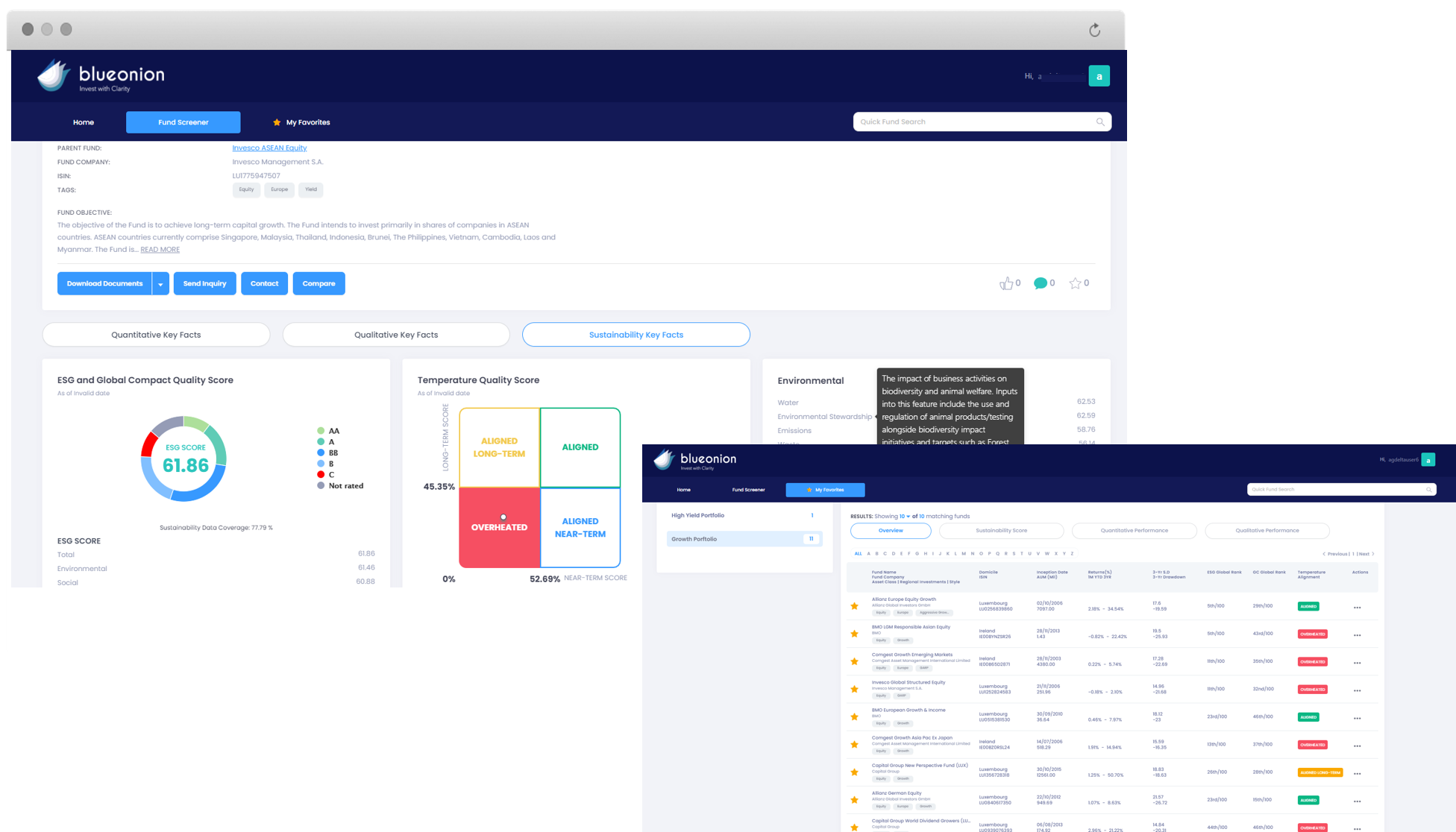

Negative or positive screening funds using Qualitative and ESG metrics to meet a client's special mandate or to fill the product catalog gap. Solutions fully customized to meet regulatory requirements. Data is hosted through layers of security and tier-one private cloud for IP protection. One-stop solution to govern the quality of the funds and communicate through a full cycle of the 6-modular digitized due diligence workflow. Manage your funds and search by risk profile, asset types, styles, region, and integrate your in-house views to the dedicated key facts page library. Broaden the breadth of your research process by accessing the BlueOnion Fund Hub with an extensive database of funds of over 140,000 funds globally covering 85%+ of the global market caps, using a multi-dimensional analysis - quantitative, qualitative, and sustainability screening for the most optimal results. Access peer-group commentaries and assessments about the strategies before onboarding, allowing you to optimize opportunities that go beyond numbers. To make the best manager selection decisions, you need a comprehensive data analytic tool for screening beyond hindsight. BlueOnion quantifies the 438 qualitative metrics to give you 48 KPIs so you can understand the managers' thought processes and the team disciplines. Sustainability performance algorithm studies for the Constituents sustainability behavior giving you an overview of the ultimate scores on ESG topics and the fund's temperature alignment. The BlueOnion community is like no others. We are not aiming for fame or to associate with the elites. We are a down-to-earth community that welcomes gatekeepers and investors who are like-minded to join our unique forums seeking to get down to the truth of what's behind the asset managers' scene and drive best practices. The forums tackle market challenges and demands for technology and sustainability solutions, so our members can benefit from scalable services. The solution architecture provides several security layers, with each enterprise owning a virtual private cloud in a dedicated environment hosted by tier-one cloud provider AWS. These layers are designed to protect the enterprise data and the data submitted by the fund houses with state-of-the-art security and encryption. Our team is well versed in ensuring you have the most updated regulatory changes so that your solution is most compliant. Solutions fully customized to meet regulatory requirements. Data is hosted through layers of security and tier-one private cloud for IP protection. Negative or positive screening funds using Qualitative and ESG metrics to meet a client's special mandate or to fill the product catalog gap. One-stop solution to govern the quality of the funds and communicate through a full cycle of the 6-modular digitized due diligence workflow. Manage your funds and search by risk profile, asset types, styles, region, and integrate your in-house views to the dedicated key facts page library. Join an exclusive industry consortium to share market trends, challenges, and demands for technology solutions and benefit from scalable services.

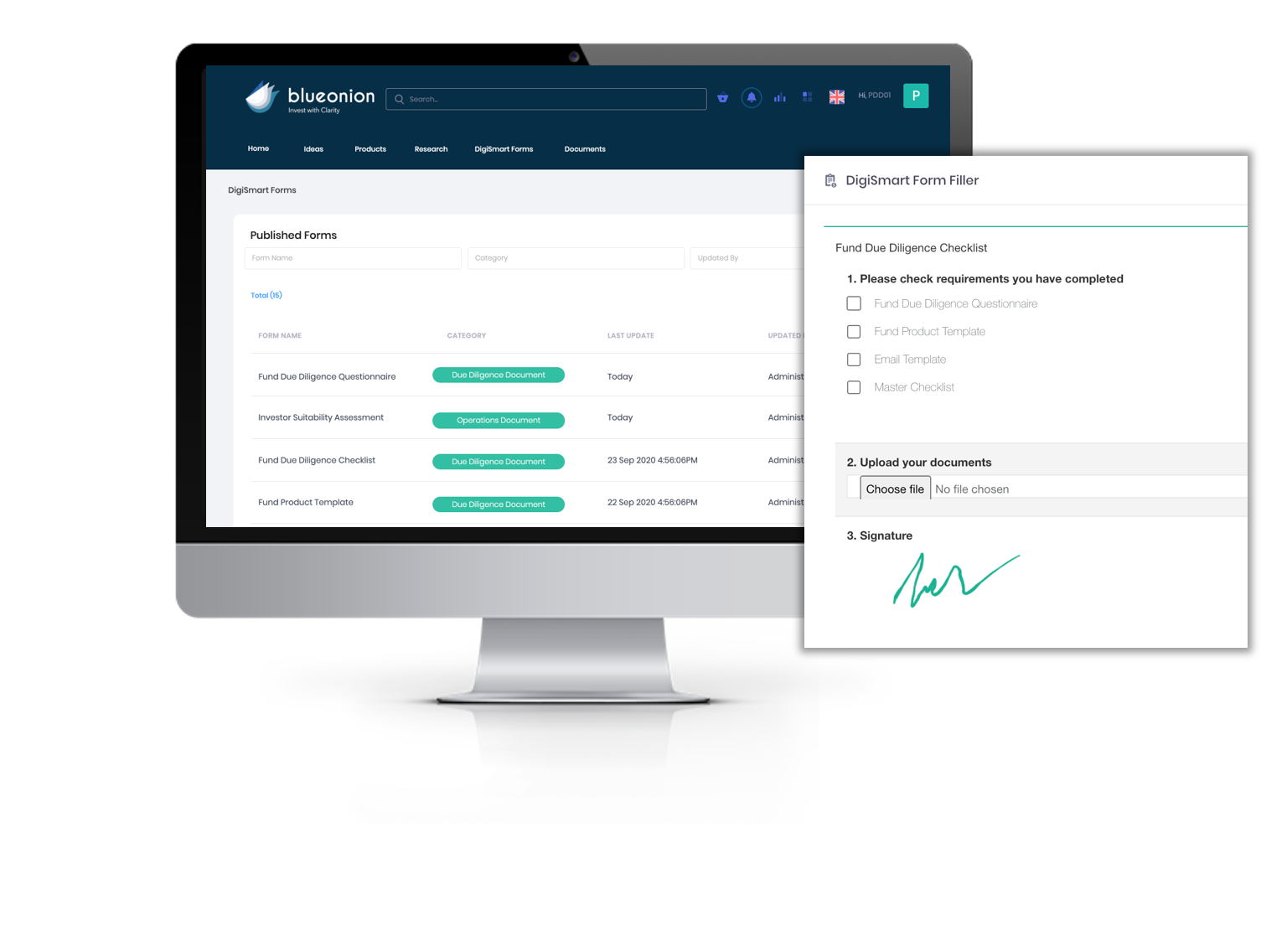

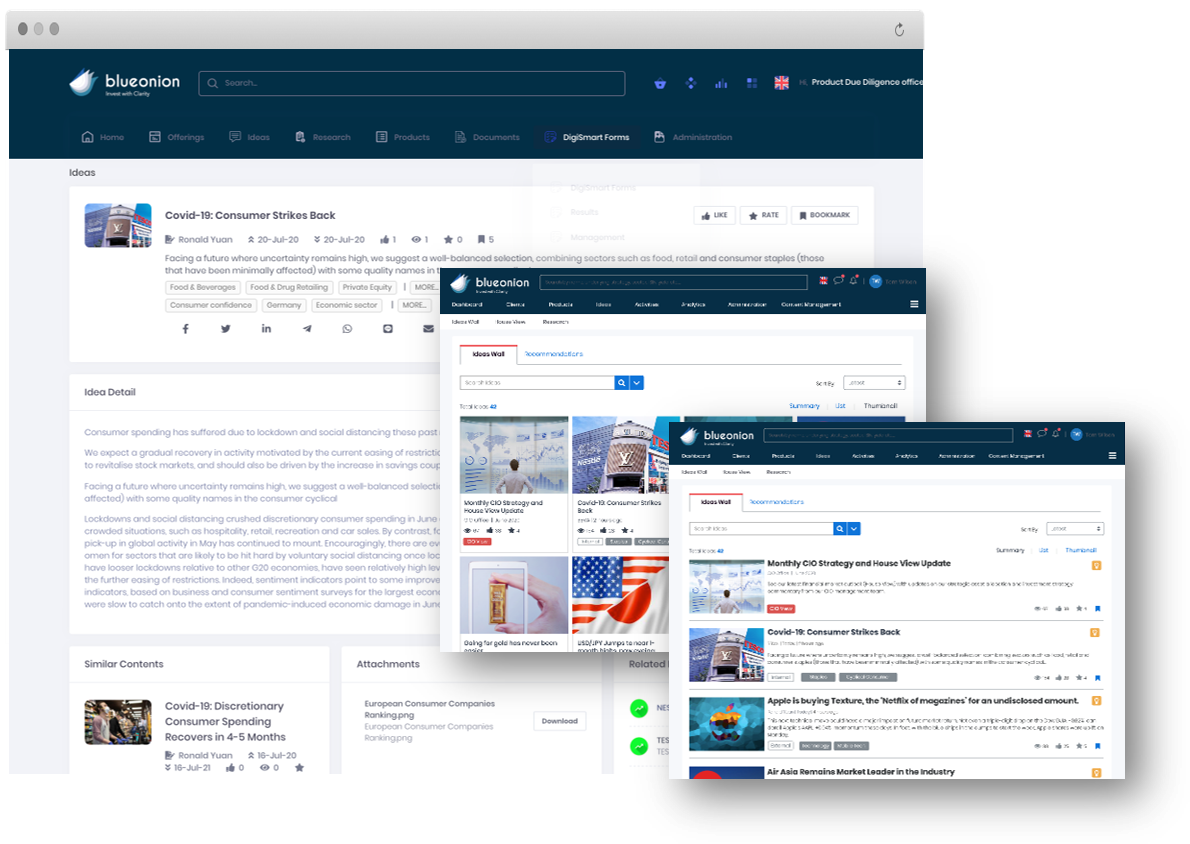

Join industry peers at the Gatekeeper Forum and meet senior asset managers face-to-face and discover the underdogs. Unlike other research platforms, BlueOnion features detail subsets of backward-looking quantitative data, forward-looking team practice data, and impact-driven sustainability data. BlueOnion’s advanced search allows you to identify the funds that are most ESG focused and the most temperature aligned quickly. The sustainability-based filtering tool comes bundled with the quantitative and fundamental data on a universe of 147,000 active, passive funds and ETFs and 8,000+ companies, using 250 ESG metrics from 30,000 sources in over 170 countries. The platform allows you to perform comparisons between favorite groups of funds efficiently. The highly visual comparisons on returns and risks, qualitative capability, ESG, GC, and Temperature alignment make identifying the high performers much easier. Set up your team dashboard and invite fund houses to pitch by following your requirements and checklist for submission such as DDQ, suitability documents, key fact statements, etc… Access the BlueOnion’s full sets of DDQ and integrate them with your in-house metrics, e-signature, documents, submission, multi-format, logic, submission tracking, due diligence process tracking, EO PDD checklist, etc.… A dashboard view of fund houses’ due diligence document submissions and the tracking of submission status. Review the Multi-Format/Logic Digital Questionnaire, add comments to incomplete forms. Receive a notification when a document is received, see submission progress % of completion from the fund house, and automatically receive reporting when the entire DDQ process is completed. Approve or reject a fund or comment for future improvement. Upon approval of a mandate, export due diligence reports, set up digital forms and templates for AR analysis templates, share class, launch emails, and pre-trade in excel or PDF. Set frequency for the fund house’s reporting and receive notifications when the documents are received daily, weekly, monthly, etc. A dedicated page is provided for each fund onboarded with a summary, ideas, research, videos, and the bank’s internal commentaries regarding the advisory team’s fund to sell. Manage all approved funds list in “My Product Catalog” and search by asset types, region, risk profile, themes, investment styles, etc in tiles or list views. Access the product key fact page with supporting narratives, documents, ideas, and research. Incorporate house views and commentaries to the key facts page and provide an extra mile for RM and the advisory team. Stay focused and hold onboarded asset managers and their funds accountable while monitoring shortlisted portfolios on the go. Access the snapshot of funds along the three dimensions of performance and risks, qualitative behavior along five pillars over 48 key indicators, plus ESG, GC, and temperature alignment performance. 盡職治理及負責任投資. 拍攝日期2022年 BlueOnion行政總裁 Elsa Pau, 周尚頤博士 Christine Chow, PhD 及戴潔瑩博士 Agnes K Stewardship & Responsible Investing with Dr. Christine Chow & Dr. Agnes K BlueOnion’s Chief EC.ESG Investment Strategist Dr. Agnes K Y Tai was invited BlueOnion’s Chief Sustainability Officer Dr. Jeanne Ng discusses challenges in adapting to BlueOnion's Chief Sustainability Officer Dr. Jeanne Ng was recently featured in a Founder and CEO Elsa Pau joined industry experts in discussion of key Elsa Pau of BlueOnion comments on state of climate-related financial reporting in Qualitative and ESG Screening

Product Due Diligence Workflow

Product Catalog and Profiling

Live Gatekeeper Community

Gatekeeper Workbench

Integrated solution for

product due diligence

How it works

screening to approval under

one centralized platform

Fund Screening

Security & Compliance

RFP Management

Catalog Indexing

Benefits

Access the best intelligence

With centralized data management

Scalable Research

A Data Driven Approach

An Exclusive Community

Security & Compliance

Security & Compliance

Fund Screening

RFP Management

Catalog Indexing

Peer to Peer Consortium

Shopping Network

Bespoke Workflow

Gatekeeper Workbench

6-Modular Streamlined Process

01. Screening

02. Initiation

03. Tracking

04. Onboarding

05. Indexing

06. Monitoring

Our Services

We run all kinds of IT services

with 10 years of experience

Team Members

Meet Our Experienced

Engineers

Team Members

Meet Our Experienced

Engineers

Fatima Haque

Mushfiqur Rahim

Angel Zara

Adam Minle

1024

Satisfied Clients

140

+

Project Complate

100

International Awards

120

+

Experienced Engineer

Case Study

Some Of Our Latest

Case Studies

Pricing Plan

A Plan which Best Matches

your Needs

![]()

Business

![]()

Economy

![]()

Premium

Testimonial

Our Customers Very Happy

with our services

In the Media

Check out

Our Latest Media Coverage

Developer

CEO & Founder

UI/UX Designer

Web Developer

$

199

/ mo

$

99

/ mo

$

279

/ mo