Identify

Analyze

Investigate

Engage

Your research partner

Identify the Best

Stewards for your Investments

As your sustainable investment objectives evolve, you want a partner who understands the behavior of the buy and sell-side of investments and focuses on your goals with genuine interests.

BlueOnion brings transparency and clarity to global funds and companies in the public market, encouraging investors to make informed and sustainable decisions.

While many are judging their managers by hindsight performance and luck, BlueOnion serves as a third-party validator to confirm that managers are for real, walking their talks, practicing what they preach, and are exercising best stewardship for the investors' capital.

Responsible Screening

Identify The

Right Companies & Funds

BlueOnion's advanced search allows you to identify the funds that are most ESG focused and the most temperature aligned quickly. The sustainability-based filtering tool comes bundled with the quantitative and fundamental data on a universe of 400,000 active, passive funds and ETFs and 40,000+ companies, using 250 ESG metrics from 30,000 sources in over 170 countries.

Filtering

Shortlisting

Analyze

Perform in-depth

Peer analysis

BlueOnion allows you to drill deeper into a strategy. Compare funds of the same types over 50 KPIs, with 41 Qualitative metrics with 189 attributes derived from over 530 inputs of the five key pillars to understand sustainable performance's potential over the long term. In addition, 22 sustainability topics, 33 business involvement filters, and 5 forward-looking climate indicators, to help spot performers aligned to your value.

Instant Due Diligence

Engage with managers

Manager Selection

Five Pillars of

Qualitative Research

The tool leverages drills deeper into a strategy. It quantifies the 41 Qualitative metrics with 189 attributes derived from over 530 inputs of the five key pillars to understand sustainable performance's potential over the long term. The feature layer aggregates hundreds of inputs along the five critical pillars of a fund’s qualitative strength, rather than relying on hindsight and past performances.

Investment Process

Portfolio Construction

Performance & Risk

Stewardship

Corporate Quality

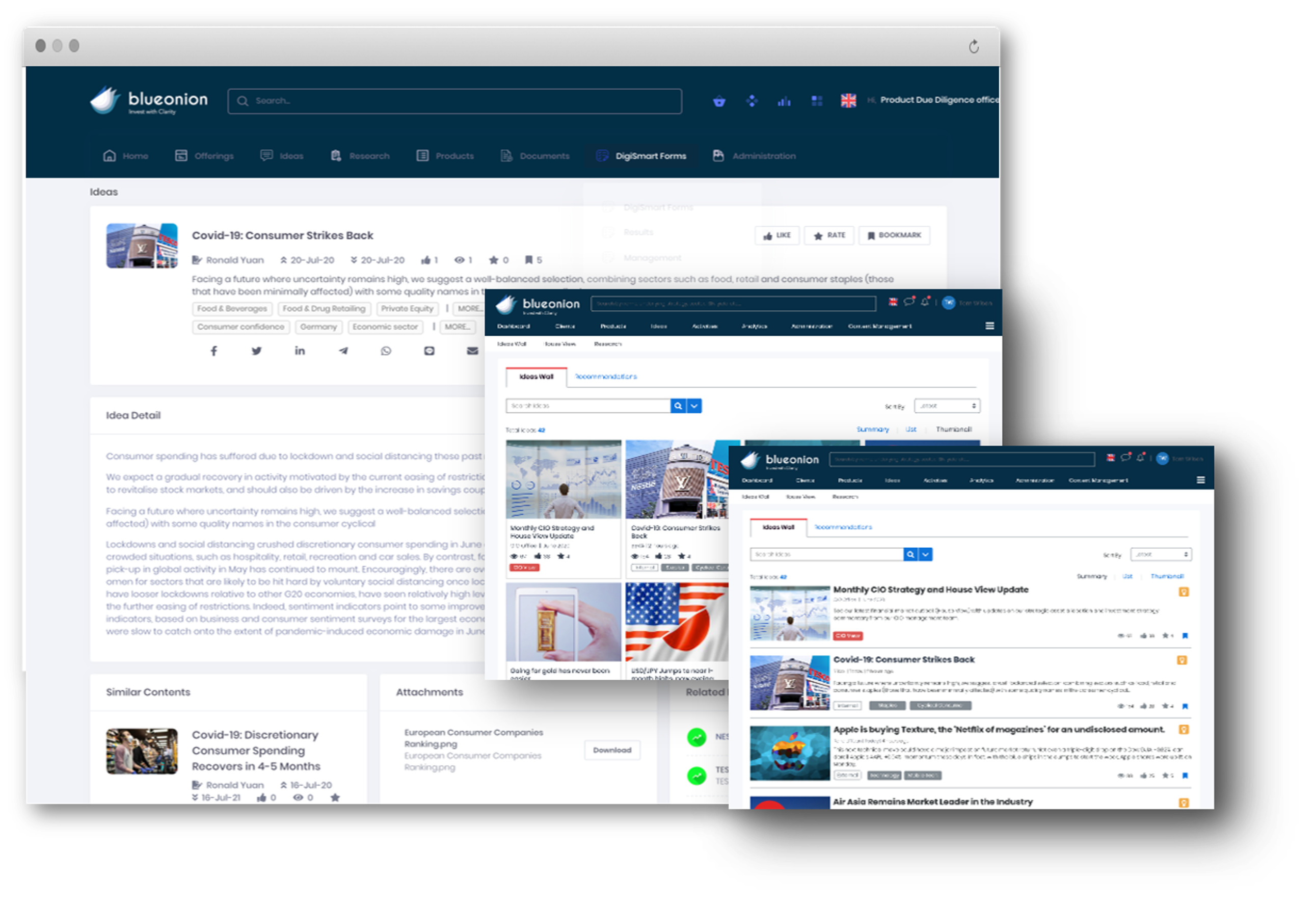

Investigate

Streamlined

Due Diligence Workflow

Interactive dashboard to manage the approval process for funds you're interested for your mandate. View factsheets and other documentation and evaluate the qualitative feasibility using the BlueOnion metrics. Communicate with the manager directly and receive notifications when a document has been received. Take actions for funds that are approved or rejected.

RFP Initiation

Peer Experience

Engage

Exclusive Platform

For Manager Intelligence

A comprehensive library to feature the best-of-the-best managers and strategies selected by a prestigious panel of gatekeepers. The Gatekeeper Register is also a live forum where interviews with Fund Managers and CIOs are held annually in different time zones allowing asset owners and due diligence personnel to conduct a deeper analysis of the team and the strategies.

Research and Ideas

Exclusive gatekeeper access to award-winning strategies packed with videos, documents, research, reports, ideas, and themes related to the fund.

P2P Commentaries

A collection of commentaries and observations shared by asset owners, gatekeepers, and consultants for peer assessment. A must-read before onboarding.

Gatekeeper Forum

A highly curated forum that connects the buy and sell-side of funds and empowers gatekeepers to look under the hood before they invest.

Get in touch

arrange for a guided

BlueOnion tour

Schedule a Guided Tour Today!!!

Our Blog

Check Out

Our Latest Articles

盡職治理及負責任投資. 拍攝日期2022年 BlueOnion行政總裁 Elsa Pau, 周尚頤博士 Christine Chow, PhD 及戴潔瑩博士 Agnes K

Stewardship & Responsible Investing with Dr. Christine Chow & Dr. Agnes K

BlueOnion’s Chief EC.ESG Investment Strategist Dr. Agnes K Y Tai was invited

BlueOnion’s Chief Sustainability Officer Dr. Jeanne Ng discusses challenges in adapting to

BlueOnion's Chief Sustainability Officer Dr. Jeanne Ng was recently featured in a

Founder and CEO Elsa Pau joined industry experts in discussion of key

Elsa Pau of BlueOnion comments on state of climate-related financial reporting in