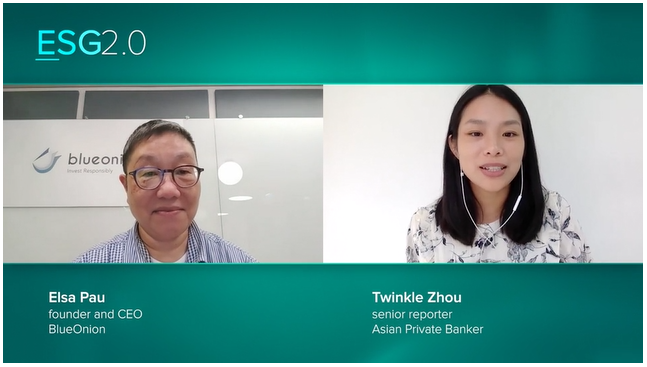

Published on January 29, 2021 Founder and CEO Elsa Pau joined industry experts in discussion of key topics in Green Sustainable Finance. The Organizer’s recap – On January 28, we have invited industry experts at the forefront of green and sustainable finance in Hong Kong to join our panel. By combining science, data, technology and… Continue reading Biz@HKUST ESG Webinar – Mobilizing Capital for the Brown to Green Transition: Panel of Catalysers