In the evolving landscape of sustainable finance, financial institutions across Asia-Pacific face increasing pressure to measure and disclose their indirect greenhouse gas (GHG) emissions—commonly referred to as Scope 3, Category 15 (financed emissions). As regulators tighten climate disclosure requirements and investors demand greater transparency, asset managers and banks must adopt robust methodologies to assess their climate impact. The Partnership for Carbon Accounting Financials (PCAF) has emerged as the leading global framework for measuring financed emissions, helping financial institutions align with climate goals and regulatory expectations. However, its implementation in the region presents both challenges and opportunities.

The Growing Regulatory & Investor Mandate

Regulators worldwide are increasingly incorporating financed emissions disclosures into their sustainability frameworks, driving financial institutions toward greater climate accountability. In the European Union, the Corporate Sustainability Reporting Directive (CSRD) requires financial institutions to report financed emissions in accordance with European Sustainability Reporting Standards (ESRS), which reference PCAF methodologies. Canada’s Office of the Superintendent of Financial Institutions (OSFI) has implemented similar requirements for banks and insurers, while the UK’s Transition Plan Taskforce (TPT) aligns its recommendations with PCAF principles. Even in jurisdictions where Scope 3 disclosures are not yet mandatory, voluntary adoption is gaining momentum as financial institutions prepare for future regulatory shifts.

In the Asia-Pacific region, regulatory momentum is accelerating. Japan’s Financial Services Agency (FSA) encourages banks to disclose climate risks under the Task Force on Climate-related Financial Disclosures (TCFD) framework, indirectly supporting PCAF adoption. Australia’s Prudential Regulation Authority (APRA) has introduced climate risk guidance, prompting banks to integrate financed emissions into their risk models and reporting frameworks. In Singapore, the Monetary Authority of Singapore (MAS) is pushing asset managers toward enhanced sustainability disclosures, further reinforcing the role of PCAF‘s standardized approach.

Other financial hubs in the region are also taking action. In Hong Kong, the Securities and Futures Commission (SFC) has explicitly referenced the PCAF Standard in its guidance for large fund managers calculating GHG emissions across asset classes. Meanwhile, in Taiwan, CTBC Holdings became the first financial institution in the region to formally commit to PCAF, signaling growing industry recognition of its importance.

Beyond regulatory mandates, investor demand for financed emissions data is surging. Institutional investors—particularly those aligned with the Net-Zero Asset Owners Alliance (NZAOA) and the Science Based Targets initiative for Financial Institutions (SBTi)—increasingly expect asset managers to quantify, disclose, and mitigate their carbon footprint. Without credible emissions data, financial institutions risk losing access to capital, facing reputational risks, and missing out on emerging opportunities in sustainable finance.

The Challenges of Implementing PCAF in APAC

Despite its clear benefits, implementing PCAF across Asia-Pacific presents significant challenges, particularly around data availability, methodology, and integration with existing risk management frameworks.

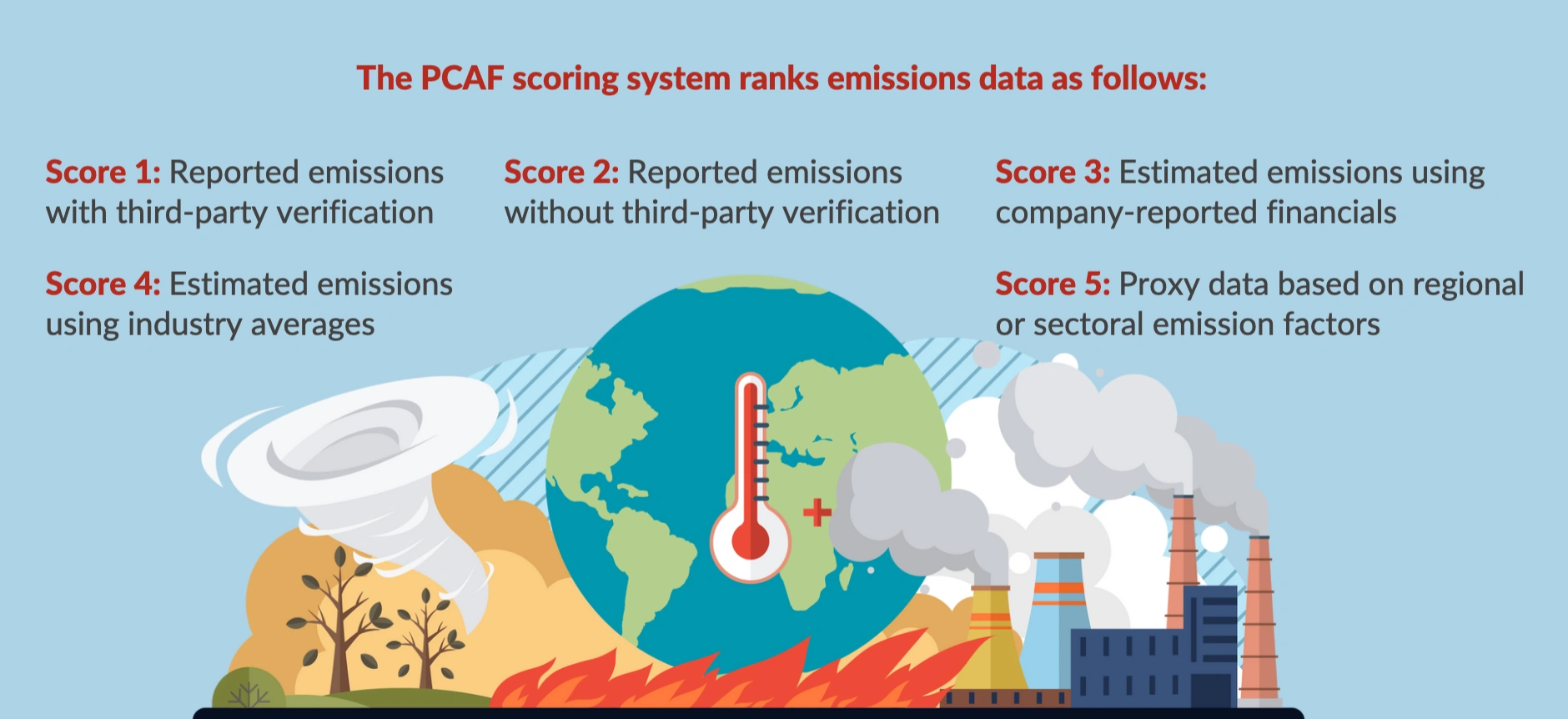

One of the most pressing issues is data quality. Unlike Europe and North America, where corporate emissions disclosures are more mature, many APAC markets lack comprehensive and reliable emissions data. Small and medium-sized enterprises (SMEs), private equity investments, and sovereign bonds often present data gaps, making accurate financed emissions calculations difficult. While PCAF provides a data quality scoring system (ranging from 1 to 5) to assess emissions data reliability, many financial institutions struggle to obtain high-quality, company-reported emissions data.

The PCAF scoring system ranks emissions data as follows:

- Score 1: Reported emissions with third-party verification

- Score 2: Reported emissions without third-party verification

- Score 3: Estimated emissions using company-reported financials

- Score 4: Estimated emissions using industry averages

- Score 5: Proxy data based on regional or sectoral emission factors

Most financial institutions in APAC currently rely on Score 4 or 5 data, which reduces accuracy and increases uncertainty in climate risk assessments. Without robust verification mechanisms, institutions risk overstating or understating their financed emissions, leading to flawed risk management and regulatory compliance issues.

By leveraging industry-specific data, we better reflect the true emissions activities of financed assets, reducing potential distortions in carbon accounting.

Financial institutions also face methodological challenges. PCAF‘s framework requires institutions to allocate emissions based on their share of financing, which can be complex when dealing with syndicated loans, structured products, or multi-asset portfolios. Additionally, institutions must determine how to set decarbonization targets and engage with high-emission clients without simply divesting from carbon-intensive sectors—a challenge that requires strategic thinking and long-term transition planning.

Turning Challenges into Opportunities

Despite these obstacles, financial institutions that proactively adopt PCAF can gain a competitive advantage in sustainable finance. By measuring financed emissions, banks and asset managers can improve their risk assessment capabilities, align with global climate commitments, and build trust with investors and regulators.

Implementing PCAF also opens the door to innovative financial products. Institutions that accurately quantify their financed emissions can develop sustainability-linked loans, green bonds, and transition finance solutions that offer preferential terms to clients committed to decarbonization. This not only enhances climate impact but also unlocks new revenue streams in a rapidly growing market for sustainable finance.

Moreover, PCAF-aligned disclosures help institutions future-proof their business models. As climate regulations continue to evolve, early adopters of financed emissions accounting will be better positioned to comply with emerging disclosure requirements, avoiding the risk of regulatory penalties or last-minute reporting challenges.

How Smart Green FinTech can Ensure Data Accuracy

Implementing PCAF standards requires reliable data, scenario analysis, and risk assessment. BlueOnion helps financial institutions assess and manage financed emissions through automated disclosures and climate scenario modeling.

A key challenge in PCAF adoption is data accuracy. BlueOnion’s climate risk module assigns a PCAF data quality score (1-5) to each asset, enabling institutions to quickly identify reliable emissions data and areas requiring estimates or proxies.

With BlueOnion, financial institutions can improve data accuracy by identifying gaps and engaging with companies that provide verified disclosures. The platform ensures compliance with Hong Kong’s SFC and Singapore’s MAS requirements, while simplifying reporting through automated portfolio analysis and regulator-ready reports. Additionally, its capabilities enhance risk management by transforming emissions data into actionable insights for credit risk and portfolio strategy.

BlueOnion improves emissions data accuracy by offering broad investment coverage across corporate bonds, equities, and sovereign bonds. It provides detailed corporate bond assessments, tracing up to six levels of parent-child relationships, and employs a look-through methodology for fund-of-funds, tracking up to four levels of holdings. Regular data updates incorporate the latest emissions and EVIC/GDP figures every month, ensuring institutions always have up-to-date insights.

Beyond reporting, BlueOnion’s climate scenario modeling helps institutions assess climate risks and make informed investment decisions. By integrating financed emissions data with predictive analytics, institutions can better navigate transition risks and support decarbonization efforts.

Looking Forward

As the financial sector faces increasing scrutiny over its role in the climate transition, measuring and disclosing financed emissions is no longer optional—it is a strategic imperative. PCAF provides a standardized, globally recognized framework to help banks and asset managers quantify their climate impact, comply with evolving regulations, and position themselves as leaders in sustainable finance.

While implementing PCAF across Asia-Pacific presents challenges, financial institutions that proactively address data quality issues, integrate emissions metrics into risk management, and leverage advanced climate modeling tools will be best equipped to navigate the transition. By embracing PCAF today, financial institutions can not only meet regulatory expectations but also unlock new opportunities in the sustainable finance landscape of tomorrow.

For those looking to enhance the accuracy and reliability of their financed emissions disclosures, BlueOnion offers a powerful solution. Get in touch for a test drive today @ chris.hay@blueonion.today