-

May 20, 2025

Responsible Capitalism is at the hands of the asset owners to drive changes for the generations to come. They do that by investing directly in socially responsible companies or through managers with the best stewardship.

Find the like-minded investment managers

Define a peer group, compare and deep dive

Dive into the three-dimensional lenses

Meet the managers and validate their pitches

As your sustainable investment objectives evolve, you want a partner who understands the behavior of the buy and sell-side of investments and focuses on your goals with genuine interests.

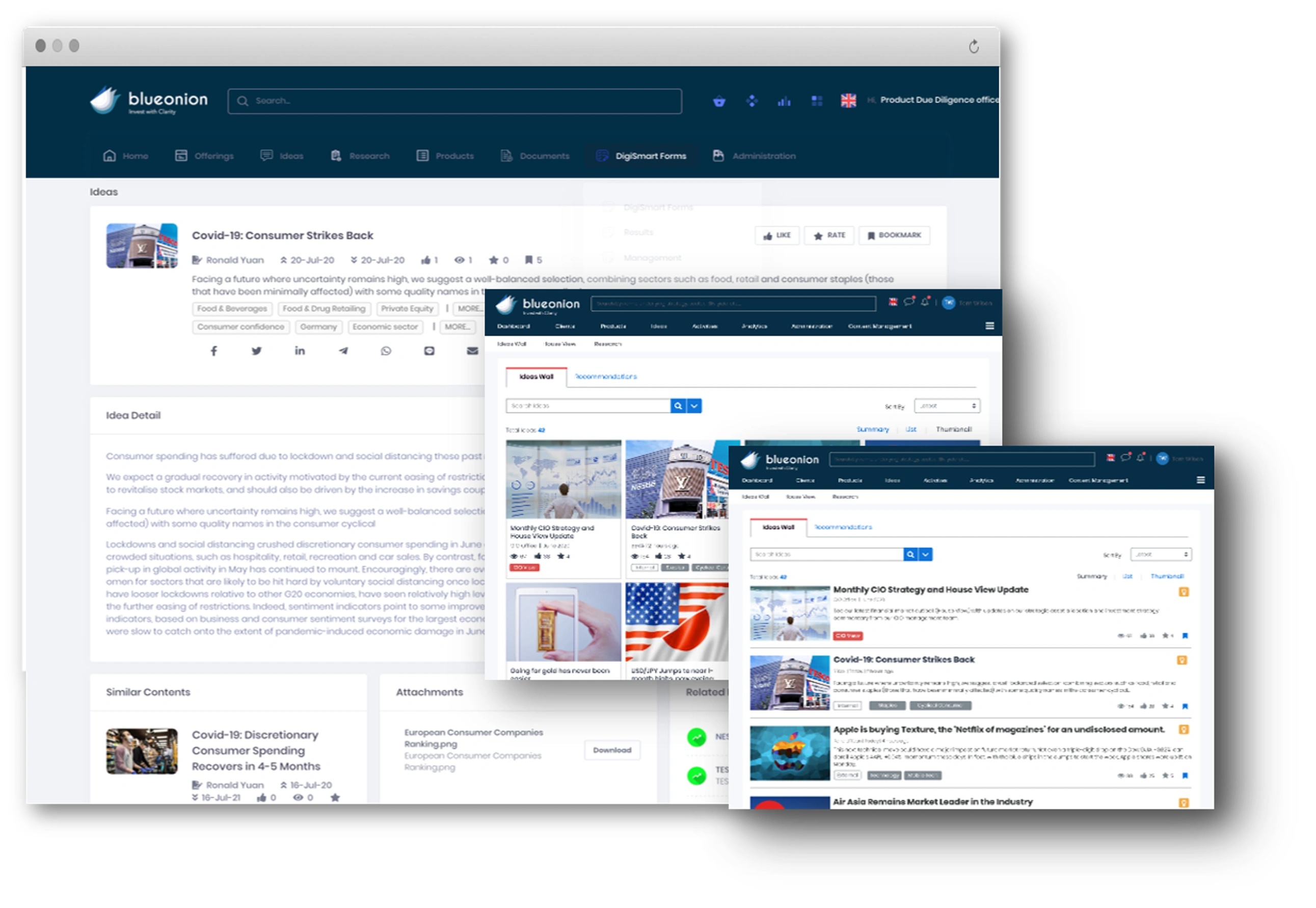

BlueOnion brings transparency and clarity to global funds and companies in the public market, encouraging investors to make informed and sustainable decisions.

While many are judging their managers by hindsight performance and luck, BlueOnion serves as a third-party validator to confirm that managers are for real, walking their talks, practicing what they preach, and are exercising best stewardship for the investors' capital.

BlueOnion's advanced search allows you to identify the funds that are most ESG focused and the most temperature aligned quickly. The sustainability-based filtering tool comes bundled with the quantitative and fundamental data on a universe of 400,000 active, passive funds and ETFs and 40,000+ companies, using 250 ESG metrics from 30,000 sources in over 170 countries.

BlueOnion allows you to drill deeper into a strategy. Compare funds of the same types over 50 KPIs, with 41 Qualitative metrics with 189 attributes derived from over 530 inputs of the five key pillars to understand sustainable performance's potential over the long term. In addition, 22 sustainability topics, 33 business involvement filters, and 5 forward-looking climate indicators, to help spot performers aligned to your value.

The tool leverages drills deeper into a strategy. It quantifies the 41 Qualitative metrics with 189 attributes derived from over 530 inputs of the five key pillars to understand sustainable performance's potential over the long term. The feature layer aggregates hundreds of inputs along the five critical pillars of a fund's qualitative strength, rather than relying on hindsight and past performances.

Interactive dashboard to manage the approval process for funds you're interested for your mandate. View factsheets and other documentation and evaluate the qualitative feasibility using the BlueOnion metrics. Communicate with the manager directly and receive notifications when a document has been received. Take actions for funds that are approved or rejected.

A comprehensive library to feature the best-of-the-best managers and strategies selected by a prestigious panel of gatekeepers. The Gatekeeper Register is also a live forum where interviews with Fund Managers and CIOs are held annually in different time zones allowing asset owners and due diligence personnel to conduct a deeper analysis of the team and the strategies.