Our founder and CEO, Elsa Pau, moderated the SCMP Asia Sustainability Conference 2022 on Green Bonds in Asia. In summary, there is no standard, and it will not likely be a standard that everybody will agree upon any time soon. See below for a recap of some key conclusions from day 2 of the conference.

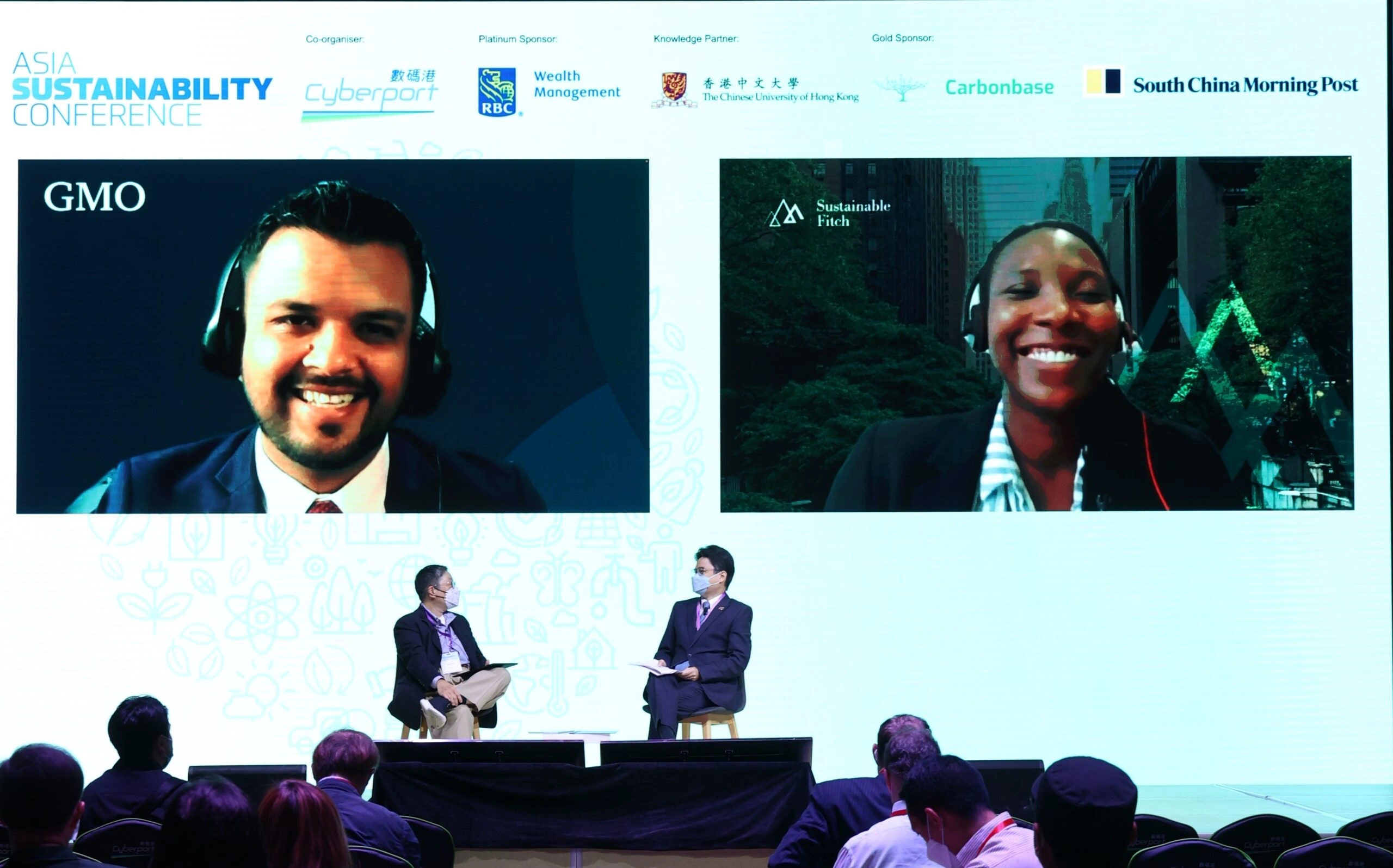

Sustainable Fitch’s Nneka Nneka Chike-Obi has seen too much lousy reporting, and prudent estimation modeling is inevitable. Green Bonds can only be rated at the issuers’ entity level, and the application of the Climate Vulnerability and ESG Relevance Score is integrated into the issuers’ ratings. TCFD is popular as it ticks all the climate boxes, but SASB has a more transparent framework, especially since it is now integrated with ISSB under the IFRS framework.

Hardik Shah, CFA, emphasized the importance of engagement and understanding their business inside out before investing is critical and shall not just rely on ratings. Advocating the integration of S and G to Green Bond consideration, especially green projects are vast consumers of labor; therefore, safety and working conditions need to be considered.

Joseph HL Chan representing the Hong Kong SAR government pledges diligence on strictly following the Green Bond Framework (GBF) and will follow closely on pre- and post-green bond issuance on their Use of Proceeds. Hong Kong will be adopting the Common Ground Taxonomy (CGT) once it is ready, and he is confident that Hong Kong will be the leader in Asia for Green Bond issuance.