What makes a good fund to invest in is its sustainability, driven by top-down management with genuine ethics. They are the best stewards for investors' capital, and they care about the planet they operate their business.

While many are judging their managers by hindsight performance and luck, BlueOnion seeks to confirm that managers are walking their talks and are exercising best stewardship for the investors' capital.

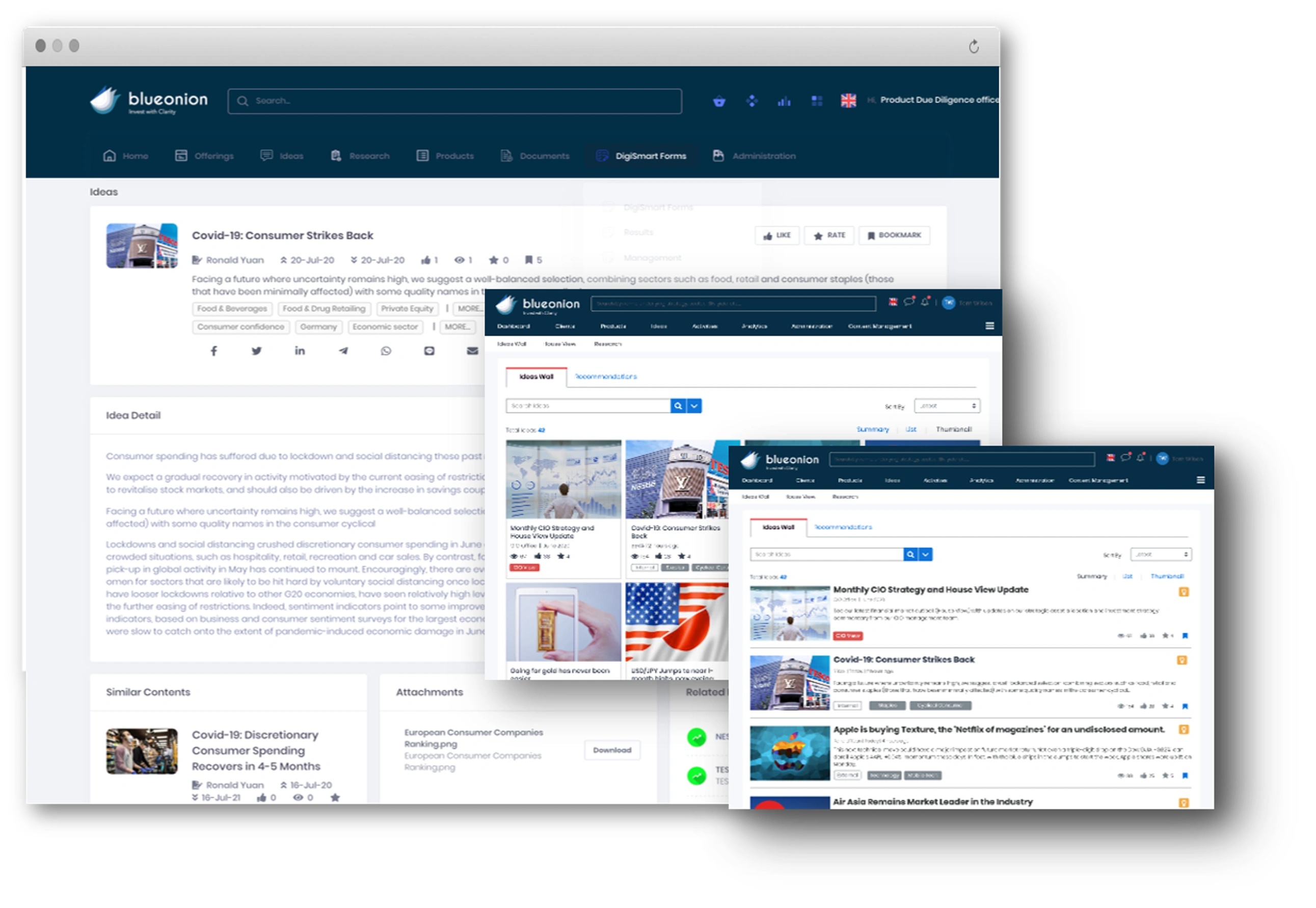

BlueOnion's advanced search allows you to identify the funds that are most ESG focused and the most temperature aligned quickly and easily. The sustainability-based filtering tool comes bundled with the quantitative and fundamental data on an unmatached universe of 300,000 active, passive funds and ETFs and 40,000+ companies, using 250 ESG metrics from 30,000 sources in over 100+ countries.

BlueOnion allows you to focus your quantitative searches and let you drill down to the constituents of the entire portfolio to preview the companies weighting, sustainability scoring and fundmentals.

Hold managers accountable with their ESG strategies by analyzing their sectors, industries, investment and divestments actions to validate that they're following their stated ESG integration philosophies. The data-driven process for outcomes reflects how they've taken materiality issues of specific ESG issues into their investment processes.

The tool leverages drills deeper into a strategy. It quantifies the 41 qualitative metrics with 189 attributes derived from over 530 inputs of the five key pillars to understand sustainable performance's potential over the long term. The feature layer aggregates hundreds of inputs along the five critical pillars of a fund's qualitative strength, rather than relying on hindsight and past performances.

A comprehensive library to feature the best-of-the-best managers and strategies selected by a prestigious panel of gatekeepers. The Gatekeeper Register is also a live forum where interviews with fund managers and CIOs are held annually in different time zones allowing asset owners and due diligence personnel to conduct a deeper analysis of the team and the strategies.